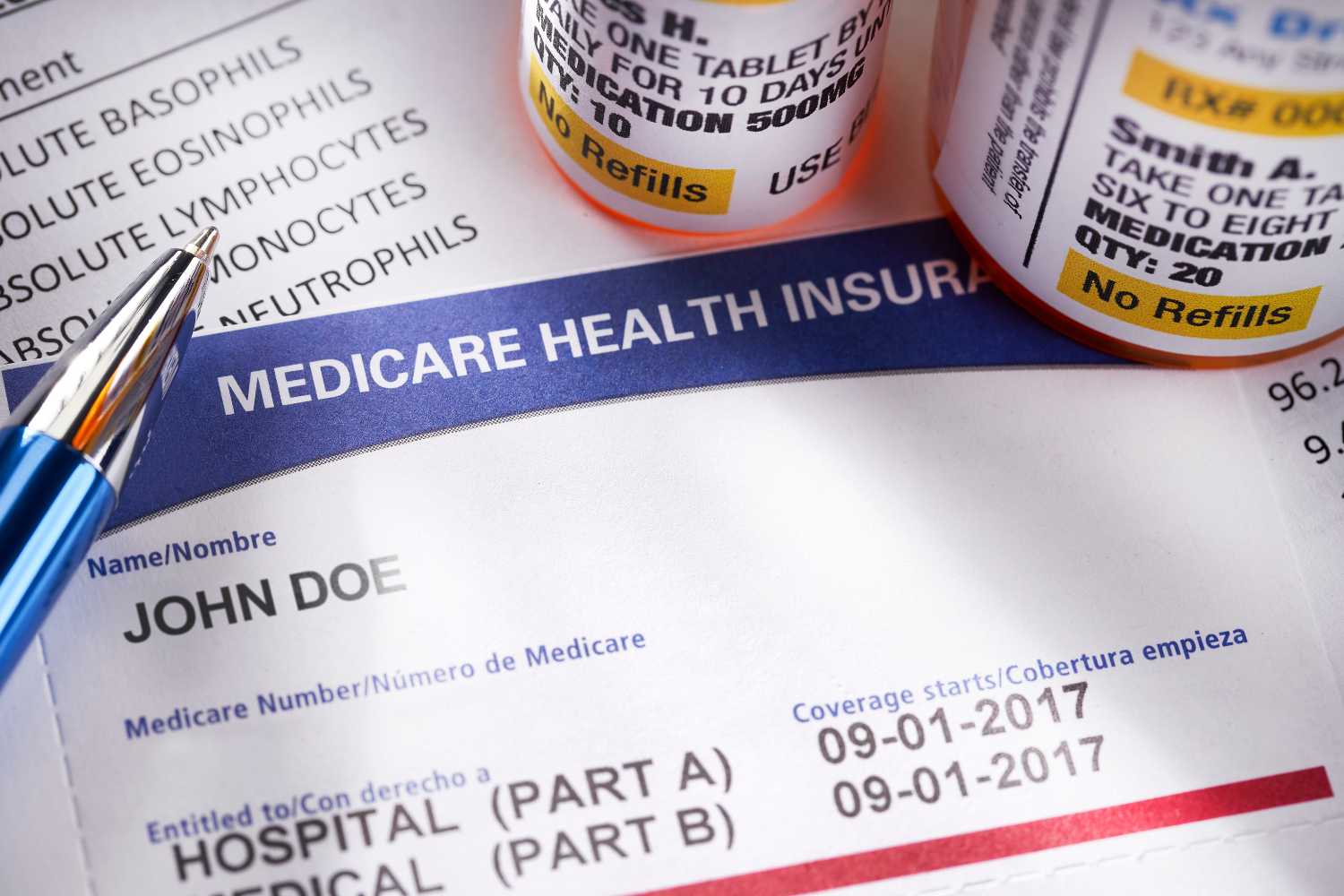

Funding Sources as Loved Ones Need More Care

Navigate the cost of medical and long-term care with confidence. Our program explores funding options like private savings, insurance, government programs, VA benefits, and reverse mortgages. Learn to identify financial […]

Funding Sources as Loved Ones Need More Care

Navigate the cost of medical and long-term care with confidence. Our program explores funding options like private savings, insurance, government programs, VA benefits, and reverse mortgages. Learn to identify financial resources and consult trusted professionals, ensuring your loved ones receive the care they need without undue stress.

Program Presenter: Ritika Kapoor, Chief Operating Officer of Elderlife Financial Services